Our message in The Wall Street Journal today piqued a lot of interest. One person we didn’t expect to agree with our thoughts, however, was Meredith Whitney.

Whitney, a banking analyst, has taken to the airwaves predicting imminent, widespread danger in the municipal bond market, eliciting challenges by many bond analysts and prominent investors, including Pimco’s Bill Gross.

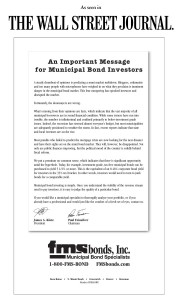

We join in the chorus of those skeptical of her dire predictions. In fact, in our message in today’s Wall Street Journal, our objective, as industry professionals with more than 35 years experience, was to offer realistic insight into the bond market, and to also reiterate some important facts: It’s important to judge the quality of municipal bonds – which is relatively simple once you understand the revenue stream used to pay investors. And in today’s charged environment, where opinions often trump facts, there are terrific opportunities in the muni market right now for individual investors.

On these points, Whitney seems to agree.

“You have to know what you own,” she told CNBC. “You have to really do your homework in terms of knowing what supports your bonds,” she said. “There are great municipal investments out there, but on a blanket basis you have to be really careful about knowing what cash flow are supporting your investments.”

We couldn’t have said it better.

To see the full message, click on the image below: